Introduction

The LG Electronics India IPO became one of the most talked-about listings of 2025, offering investors a front-row seat to a story of brand power, institutional confidence, and perfect timing.

With an impressive listing gain of around 50% on debut, LG India’s public issue delivered not just profits, but also valuable lessons for retail investors navigating a rapidly changing market.

If you’re a new investor wondering what made this IPO such a hit — this post breaks down three powerful lessons that can help you make smarter investment decisions in the years ahead.

Lesson 1: Strong Brands Build Unshakable Investor Confidence

One of the biggest reasons behind LG Electronics India’s success was the power of its brand.

When investors recognize a company’s products, values, and track record, trust follows automatically. LG has been a household name in India for over two decades — from smart TVs to home appliances, it has consistently delivered quality and reliability.

In financial markets, trust converts directly into subscription numbers. Retail investors often look for brands they use daily, assuming “If I trust it at home, I can trust it in my portfolio.”

That psychological comfort drives massive retail participation.

Example:

In 2025, LG’s IPO received over 25x subscription in the retail category, far outperforming mid-sized competitors in the consumer electronics space. That brand recall played a major role.

Investor takeaway:

- Check online consumer reviews and annual reports to gauge brand perception.

- Don’t just chase IPO hype — study the company’s brand history and consumer trust.

- Look for businesses with consistent product satisfaction and strong after-sales networks.

Lesson 2: Institutional Confidence Signals Long-Term Stability

Retail investors often follow trends. But institutions — mutual funds, insurance firms, and foreign investors — follow fundamentals.

LG’s IPO witnessed overwhelming QIB (Qualified Institutional Buyer) participation, indicating strong belief in the company’s future earnings potential.

When institutional investors commit early, it usually reflects:

- Sustainable profit margins

- Transparent corporate governance

- Long-term scalability in domestic and export markets

This confidence doesn’t just lift demand — it also stabilizes post-listing performance.

A strong institutional base helps prevent volatility after the initial listing euphoria fades.

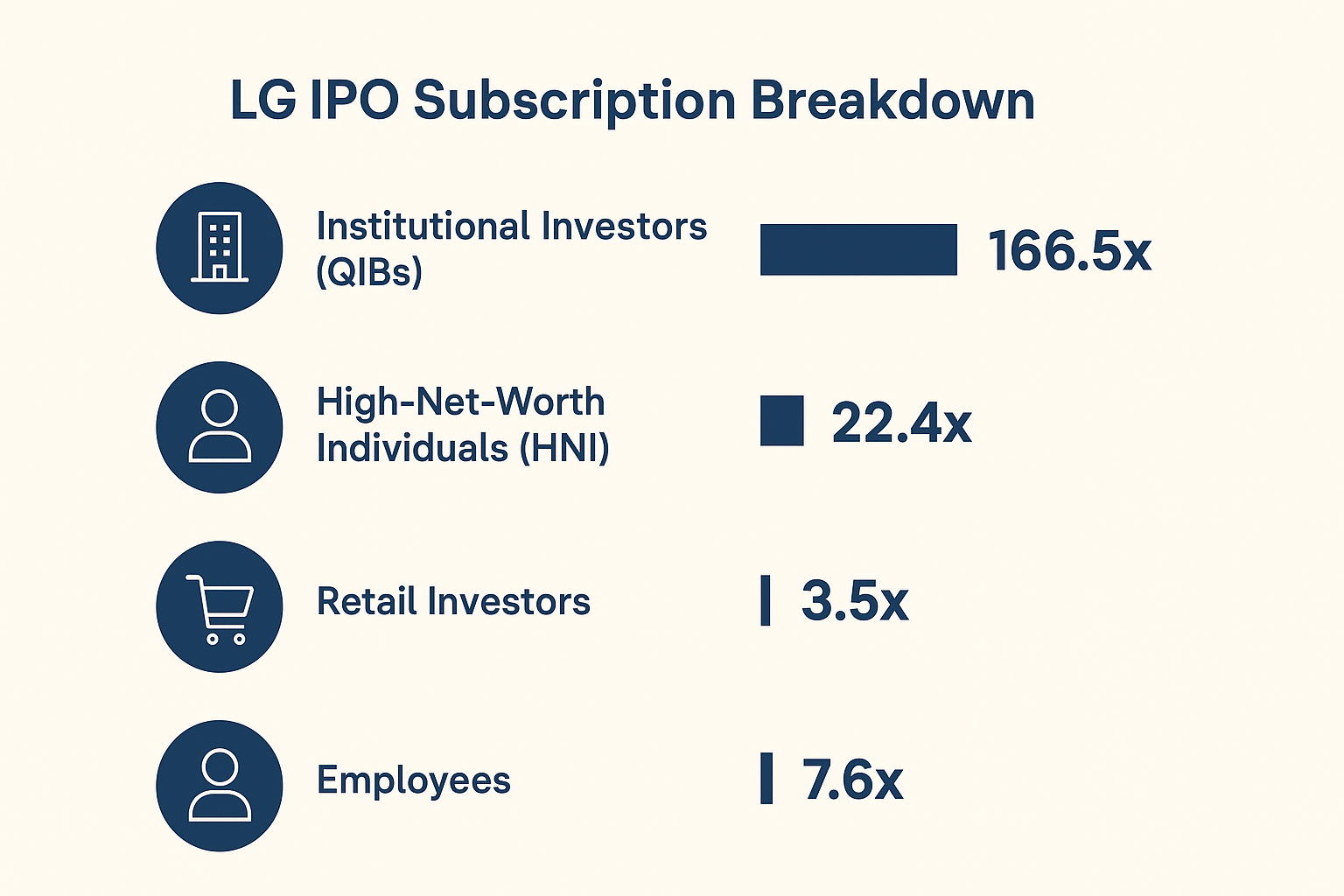

📈 LG IPO Subscription Breakdown

- Institutional Investors (QIBs): 166.5x

- High-Net-Worth Individuals (HNIs): 22.4x

- Retail Investors: 3.5x

- Employees: 7.6x

When QIBs (Qualified Institutional Buyers) invest heavily, it creates a ripple effect — signaling confidence to retail investors.

Investor takeaway:

- Use reliable sources like NSE, BSE, or Moneycontrol for subscription insights.

- Before applying for any IPO, check QIB subscription data on Day 2 and Day 3 — it’s a leading indicator of post-listing performance.

- Look for names that attract long-term institutional money, not just retail buzz.

Lesson 3: Timing and Market Sentiment Can Amplify Returns

Even the strongest IPO can underperform if it hits the market during poor sentiment.

LG Electronics India’s listing came at a time when both Nifty and Sensex were trading near record highs, and consumer electronics demand was surging post festive season.

This perfect timing magnified its success. When market liquidity is high and investor sentiment is optimistic, good companies see exceptional listing gains.

Data-backed insight:

Historical trends show that IPOs launched during bullish phases deliver an average of 25–35% higher listing gains than those launched during bearish markets.

Investor takeaway:

- Use simple indicators — e.g., Nifty trend, FII inflows, and VIX index levels — to gauge sentiment.

- Track broader market sentiment before subscribing.

- Avoid IPOs that open amid geopolitical uncertainty or falling indices.

Bonus Tip: Long-Term Returns Matter More Than Listing Gains

Many retail investors exit on listing day for quick profits, but seasoned investors think differently.

In LG’s case, analysts predict continued upside due to:

- Expanding domestic manufacturing capacity

- Focus on green technology & IoT devices

- Solid post-IPO cash flow and governance metrics

If fundamentals remain strong, such companies can outperform benchmarks over time.

Investor takeaway:

Final Takeaway: What Every New Investor Should Learn

The LG Electronics India IPO serves as a reminder that successful investing isn’t about luck — it’s about recognition, research, and rationality.

To summarize:

- Lesson 1: A trusted brand creates instant credibility.

- Lesson 2: Institutional participation confirms long-term strength.

- Lesson 3: Market timing amplifies listing gains.

And the bonus lesson — patience often pays more than adrenaline.

By studying how LG’s IPO unfolded, you can refine your strategy for upcoming issues and approach future listings with a smarter, data-driven mindset.